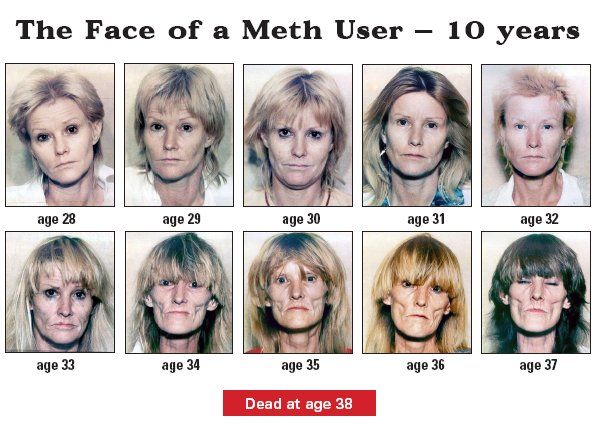

A crack addict or meth-head can

explain the whole situation. It is that

simple.

The headlines seem shocking. People living in Cyprus are losing their money, even though they thought it was safe in the bank. The US government might shut down due to debt. Banks are collapsing in Spain and the Netherlands.

|

| Cyprus bank line up during the recent crisis. Patrick Gaz - Getty Images |

The basic problem in the financial crisis is

that governments, just like a crack addict, have overspent, they are in debt and cannot break the habit. Worse still, they have made promises to pay

for expensive projects in the future, but no money for them. Banks too have overleveraged

themselves by making risky investments which

could backfire. They thought they had outsourced the risks to others,

but now they realize everyone is in the same mess and cannot pay either. (See a simple explanation of derivatives and

risk outsourcing with examples at: http://tinyurl.com/blhtc3q)

So why don’t they fix

the problem?

The answer is that

they are addicted to debt and risky spending, just like a crack addict.

At first, the addiction

to crack (debt) was just a recreational thing and only on the weekend. The money to pay for the

crack came from the savings account and did not affect the overall

financial situation. But then the crack

habit spread to the weekdays. Soon, the

funds in the savings account ran out, but the crack addict had a few credit

cards with a cash advance capability.

This went on until the crack addict got a bank letter cutting off the credit cards. No worries says the crack addict. He still has a line of credit on the equity in his heavily mortgaged condo and that can pay the

credit cards. Meanwhile, the crack addict overcharges for expenses at work. Auditing picks up on

the fraud and fires him. Our crack addict then borrows money from his family

telling them about a sure bet for the future. Everyone then finds

out he has lost his job and quits lending him money. So he steals money from his sister’s

house when there for dinner.

|

| This is your government on drugs! |

Then he gets evicted,

and our crack addict is reduced to stealing money on the street. His favored method is to steal money from savers as they

withdraw cash from an ATM. But the police get wise to him, so the broken down crack addict just beats up old ladies and steals

their purses to get that next fix and make it to tomorrow.

He gets arrested.

Once in court, he

tells the judge he is a good guy with a bad habit. He gets sent to a rehab

center paid for by the taxpayers.

He gets a financial bail out when he clears his debt through bankruptcy. So his creditors wind up losing all the money he used to pay for

years of his crack usage. Once out of rehab, our newly reformed citizen gets a

job in the financial district of the city where he lives.

All is well, until he

gets bored on the weekend and decides to head to the park to get some

crack. Not a lot. It is just for fun. And is just for the weekend.......

This is where we are at now. The

governments and banks have used every tax, fee, loan, equity, money printing, bond and accounting deferral trick

to keep spending. But the tricks have run out. They

cannot give up the the addiction, so they look around to see

who still has money. And they are planning on just taking it the same way our crack addict did at the ATM. (For an explanation of how this is possible,

see: http://tinyurl.com/cdrnm7f and http://tiny.cc/z4jcuw)

This will be the

struggle for the immediate future as the addicts who need the money take it from

those who have it.

No comments:

Post a Comment